Home swapping, also know as house swapping or home exchange, is nothing new. In fact, the vacationing alternative has probably been in use since the 1950s, at least according to Wikipedia.

But the rise of the sharing economy has been an important driver for new players entering the space, and a rethinking of the business model.

If you don’t have a clue what house swapping is, it’s basically exchanging your home (or vacation home) with others for a limited time, enabling you to take a vacation in another part of the world without the need to pay for accommodation. It’s a prime example of collaborative consumption.

Obviously, swapping houses can save you a ton of money otherwise spent on hotel bills or vacation rental fees, but it does boil down to having someone you have never met staying in your home as well.

In that sense, it differs from the likes of Airbnb and 9flats.

The Trust Issue

Unsurprisingly, enabling trust between users is key for any home-swapping marketplace provider. After all, what if the other person or family ends up trashing or stealing stuff from your home?

Several home-swapping community operators are free to use, but it seems the more reputable ones charge an annual fee of around $100 for membership on average, which makes more sense given that mutual trust comes easier when you know the other party has already coughed up dough in advance to be part of the same ‘club’.

It’s also the biggest criticism home exchange sites face: by charging a fee upfront, marketplaces essentially take users’ money for future transactions, which may not even always end up happening.

Nevertheless, home swapping is on the rise, and the success of Airbnb and its ilk is causing many home exchange marketplaces to surf the sharing economy wave, especially as potentially money-saving vacation alternatives are surging as a result of the global economic turmoil.

Back to the issue of trust, which is crucial in the home-swapping world.

Most home exchange marketplace companies, including the likes of LoveHomeSwap and CasaHop, surprisingly don’t offer insurance out of the box. In fact, I couldn’t find a single mention of the word ‘insurance’ on the website of HomeExchange, arguably the market leader and one of the oldest actors on the global home-swapping stage.

That’s strange to me, because it seems like such an essential aspect of exchanging houses with people you don’t know.

Knok Knok

Enter Knok, a fast-growing Barcelona startup whose co-founder and CEO, Juanjo Rodriguez, joined me for coffee yesterday to talk to me about the whole house-swapping phenomenon and how the market is evolving.

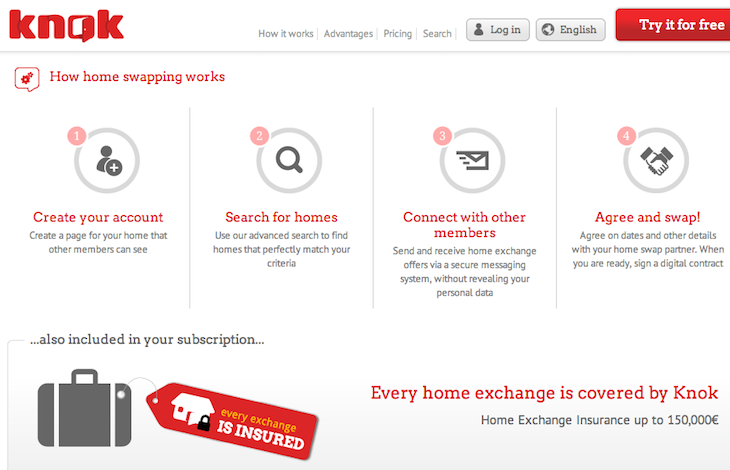

Like many of its main rivals, Knok charges a nominal fee for membership (35.7 euros for three months or 94.8 euros for one year), but the main difference is that the company includes insurance in the price.

Knok’s insurance covers damages – when they are not covered by users’ regular homeowners’ insurance – of up to 150,000 euros (almost $200,000), with a deductible of 1,000 euros.

Knok was initially launched as a spin-off from digital marketing agency Duplex in 2011, and has received a capital injection of 500,000 euros (approximately $650,000) to spur growth.

On Knok, users find home swap partners by affinity, which means that they are profiled during sign-up and then matched to other members by their interests and educational background.

Currently, the marketplace community boasts some 20,000 members, and evidently about the same amount of properties listed.

And to demonstrate what a generally safe vacationing alternative home exchange apparently is: Rodriguez tells me the company is still waiting – but not really – for the first Knok member to file an insurance claim.

The entrepreneur says the potential for Knok to emerge as the leader in digital home exchange marketplaces is there, and he thinks the tipping point is around 100,000 members/properties, which the company hopes to achieve by the end of next year.

We’ll see about that. In the meantime, why don’t you tell us if you’d consider home swapping as a vacation alternative, and why (not)?

➤ Knok.com

Top and body image credit: Thinkstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.