With the markets in a volatile state, any help that traders can get to pick the best-performing stocks is a bonus. There’s a growing movement around using social media sentiment as a guide, and SNTMNT is a startup that has today launched an API which can be used to monitor Twitter-based stock sentiment, giving advice on whether to buy or sell stock on an hourly basis.

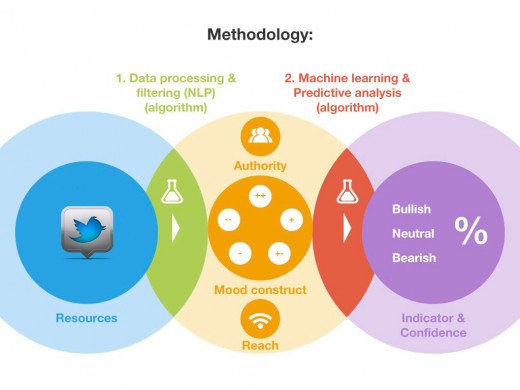

SNTMNT’s Trading Indicator API gives price predictions based on Twitter sentiment about S&P 500 index stocks. Using machine learning algorithms, the company says that it has an accuracy as high as 60%, averaging at 54%. The API can produce hourly and daily buy and sell recommendations, with a ‘confidence interval’ to indicate how accurate the prediction is likely to be.

If this sounds familiar, you may recall that we’ve previously covered Derwent Capital Markets‘ hedge fund which traded based on Twitter sentiment. However, Derwent liquidated the fund shortly after its launch in the face of tough market conditions and is now building an app aimed at day traders.

Like Derwent, SNTMNT (pronounced ‘sentiment’) is inspired by the work of Professor Johan Bollen, an academic who found correlations between the stock market and activity on Twitter. However, SNTMNT’s Vinecent van Leeuwen says that his company has taken a very different approach: “Where Bollen focuses on a very macro level of Twitter sentiment – general mood – we believe that more value can be extracted by focussing on a more micro level. The SNTMNT predictions are based on very specific fund related Twitter sentiment through stock tickers, in the way StockTwits does, and brand related sentiment (name, products, CEO).”

Van Leeuwen says that when it comes to pricing for the Trading Indicator API, they’re very much in ‘customer discovery mode’. “We’re convinced that we’ve built a great product, but also know that it’s true value yet has to be determined. We’re really looking forward to cooperate with early adopters and/or strategic partners to figure this out.”

So, should traders rely on Twitter sentiment alone for their trades? Van Leeuwen thinks that this would be foolhardy. “Anybody who claims that social media can be used as a leading trading signal is fundamentally wrong. The signal-to-noise ratio on social media channels like Twitter is (still) way too low to provide standalone trading signals, let alone a hedge fund, but definitely high enough to provide an innovative trading indicator. ”

In addition to the Trading Indicator API, SNTMNT – founded at Startup Weekend Amsterdam last year – is also launching two other APIs today. The first measures sentiment around brands (priced between free and $1500 per month depending on how many tweets you want to measure), while the other is a niche financial sentiment API aimed at structuring context from financial jargon in tweets.

➤ SNTMNT

Image credit: Bracketing Life

Get the TNW newsletter

Get the most important tech news in your inbox each week.