UK-based money transfer service Azimo has announced a £300,000 ($480,000 USD) angel investment round as it looks to expand its operations.

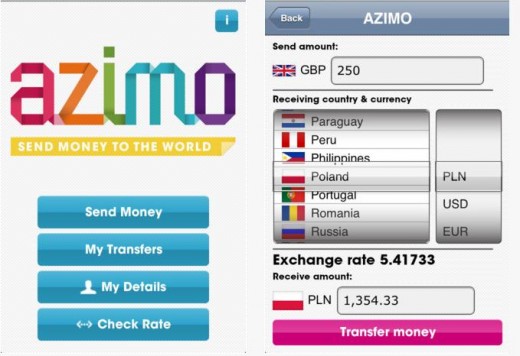

By way of a brief summary, Azimo is vying for Transferwise’s territory in the UK (see previous coverage here), and can be used to transfer money to 125 countries around the world, charging around 1-2% of the transaction. In addition to the Web portal, there’s also native mobile apps (Android and iOS), something Transferwise is still yet to deliver. There’s also Facebook integration, letting users select friends to send money, and invite friends to enter their preferred payment method.

Azimo’s investment comes from a number of individuals, including Matt Cooper, chairman of Octopus Investments, and the former principal managing director of Capital One Bank.

With Azimo, users can send money directly to any bank account, or send cash to one of 150,000 payout locations around the globe. And it’s this global aspect that the company is pinning its service on.

“The number of foreign-born residents in England and Wales has risen by nearly three million since 2001 to 7.5 million people, the 2011 census shows,” explains Azimo founder Michael Kent. “That means about one in eight – 13% – of residents were born outside the UK, with many needing to send money back home to friends and family.

“These payments can make up a significant proportion of developing world economies – for example remittances have made up 10% of the GDP of the Philippines for the past six years – with the global remittance market estimated to have reached $534bn in 2012,” he continues. “By using Azimo, these migrant workers can make sure that as big a chunk as possible of the money they send home ends up in the pockets of their intended recipient.”

Kent says his company’s prices is only part of the key selling point here. “We also aim to be more convenient than the banks and other money transfer services like Western Union, with payments usually paid within 2-24 hours – as opposed to three to five days with the banks,” he says.

Azimo launched its foreign money transfer service last July, starting with the Web, with its mobile app following in September. Azimo employs 11 staff in London and, interestingly, says it’s committed to “ethical trading”, and plans to donate 10% of its profits to charity.

Although it’s currently only being offered for those in the UK, the company does have the required regulatory clearance across the EU, but there’s no details whether this will be rolled out further afield as of yet.

➤ Azimo

Get the TNW newsletter

Get the most important tech news in your inbox each week.