Online trading gives you an opportunity be your own boss, set your work hours, work from home (or the beach), and make as much money as you want without the artificial cap placed on salaries.

However, beginner traders often have a hard time understanding how the market works – the information overload from Wall Street is more than enough to keep a beginner in a state of constant learning. As a result, they never ever feel ready to take the plunge.

Technological advancements in the finance industry have lowered the entry barrier to trading. Now, anybody can start making money from the markets with a basic understanding of how the market works, decent trading capital, and the right trading tools. In fact, financial trading tools such as bots, trading algorithms, AI, and social trading makes it easier to become successful at trading without having advanced degrees or any specialized training.

Different kinds of trading

Before getting into basics, let’s go over the different kinds of trading first:

Stock trading: Stock trading is the art of buying, holding, selling stocks (also called shares) of securities listed on public stock exchanges such as NASDAQ, NYSE, and AMEX.

Forex trading: Forex trading (also known as FX trading or currency trading) is the art of buying and selling currencies in the hopes of making profits on the difference in the value of such currencies in the global economic landscape.

Options trading: Options trading is a form of derivative trading in which people trade contracts that give them the rights (but not obligation) to buy or sell an underlying asset at a predetermined price.

Binary options trading: Binary options trading is a form of trading in which traders expect to earn a predetermined payout or nothing at all (they are also called all-or-nothing options) based on the success of their ‘prediction’ of the outcome of a specific market event.

Making your first trade

Now that you have a basic understanding of how the market works, you’ll need to decide on the kind of assets or securities you want to trade. The next decision you’ll need to make is choosing the right broker or brokerage firm through which you’ll access the markets. The broker you choose will have a direct influence on the kind of securities you’ll be able to trade, the kind of trading tools you’ll have at your disposal, how much money you’ll pay in fees, and the kind of final returns you can expect on your trades.

Some unscrupulous brokers tend to make their trading process opaque, confusing, and complex as part of efforts to fleece out more fees, transaction costs, and commissions out of beginner traders. You need to find a broker that would charge relatively low fees while still providing you with a full suite of resources to make your trading experience easier.

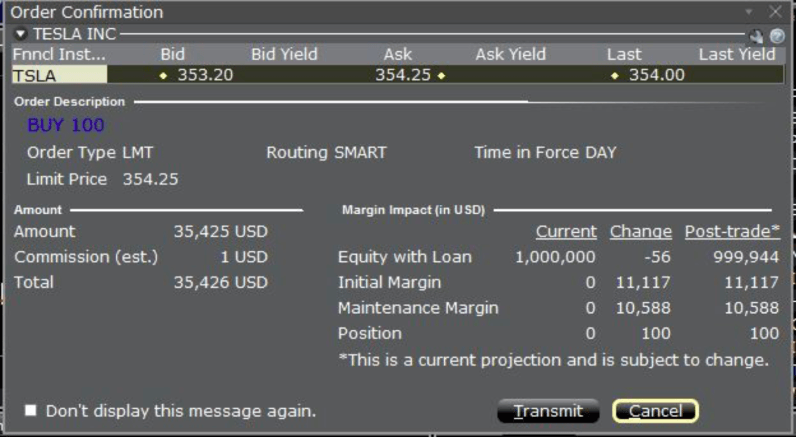

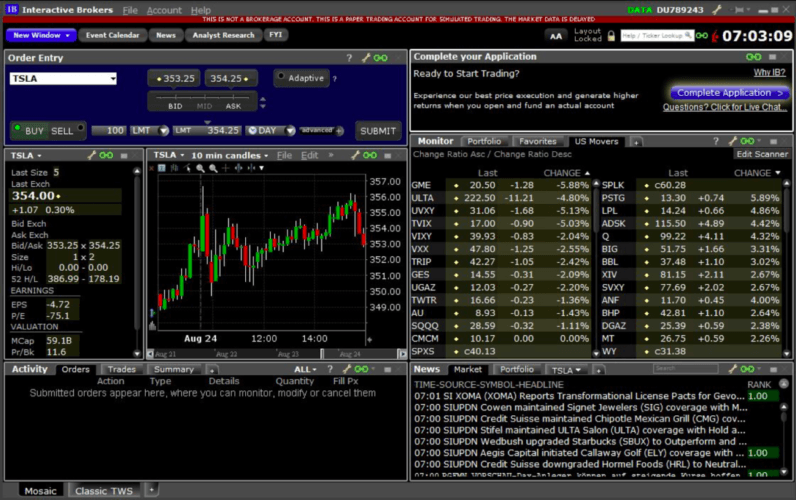

The screenshot above shows an example of a trade to buy 100 shares of Tesla Motors Inc (NASDAQ:TSLA) shares at $354.25 per share. You’ll observe that the trade has an estimated commission of $1 and the total cost of the trade will be $35,456.

Developing a trading strategy

The main differentiating factor between trading and investments is that a trader actively seeks out market movements for profit while an investor typically waits to profit from long-term price movements in the assets in their portfolio. A trader will typically make tens or hundreds of trades within a week while an investor is content to buy and hold an asset for months or years.

No trader can afford to underestimate the importance of a trading strategy – the first step in creating your trading strategy is to have a trading plan. A trading plan is akin to writing a business plan for an entrepreneurial pursuit. A trading plan helps you make logical tradition decision is periods of rapid market movement when you emotions might lead you to make rash decisions.

Your trading strategy should include a market ideology – a specific goal (getting out of debt, retiring early, making your first million) acting as your motivating factor to seek your fortune in the market. Your trading strategy should include your asset allocation and diversification moves – as a beginner, you should not have more than 5% of your trading capital on any single trade.

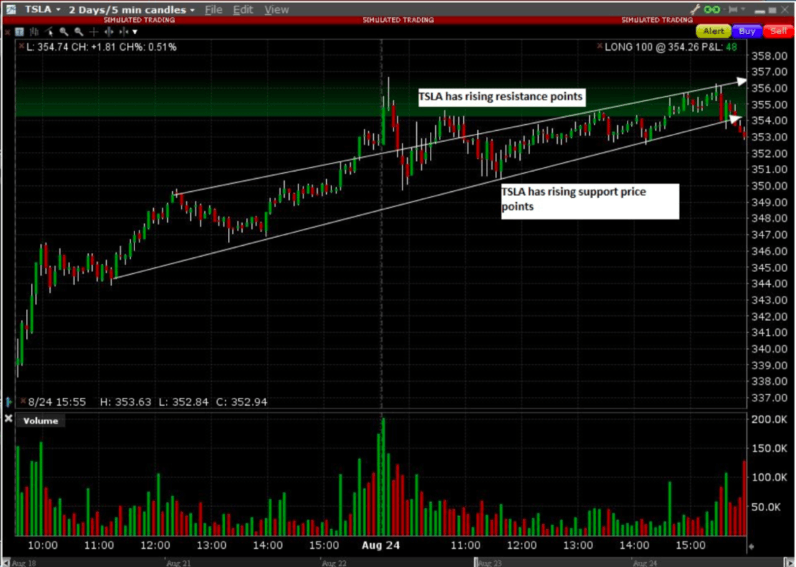

The trading chart above shows that Tesla has been in a consistent uptrend marked by rising support and resistant trend lines – for example, the stock is trending because of a catalyst such as a product launch or changes in management – in the last three weeks. The information that the stock chart provides can encourage you to hold/buy more shares of Tesla if you think that the uptrend will continue. Of course, you won’t hesitate to sell your Tesla shares to lock in your gains if you have reasons to believe that Tesla is at the peak of the uptrend.

Your trading strategy should include risk limits such as how much money you can afford to lose in a trading session (ideally not more than 5% of your capital) and how much loss you can afford to book in each trade (ideally, not more than 1% of your trading capital).

Also, make sure your trading strategy contains a mix of fundamental analysis (for example, global events, such as wars that impact oil prices) and technical analysis (trading rules based on price and volume transformations). You should use this information to determine your entry into trades, your exit when the trade goes your way, and your escape when the trade goes against your plans. It is your best interest to develop the disciple to incorporate stop/limit loss orders into every trade you place.

Using technology to beat the learning curve

Technology can help new traders lower the entry barriers to trading by automating many of the activities that could require a great deal of mental effort to track. Below are some pointers for using technology to become a better trader in the shortest possible time.

Stock screeners

If you are trading stocks, finding the right ones can be difficult because there are simply too many to pick from. Many newbie traders tend to follow the herd mentality, meaning they only trade the ‘big name’ stocks that make headlines, whereas hundreds of ‘quiet’ stocks are providing seasoned traders with consistent gains. If you trade stocks based on news alone, you’ll most likely miss the big gains; the pros often get in or out of such trades before it hits the headlines.

A stock screener can help you sieve through the thousands of stocks in the market to narrow down potential winners before their big breaks. It will help you identify top gainers and losers, stocks on turbo momentum, and stocks that are about to break out above resistance or break down below support lines, as explained above.

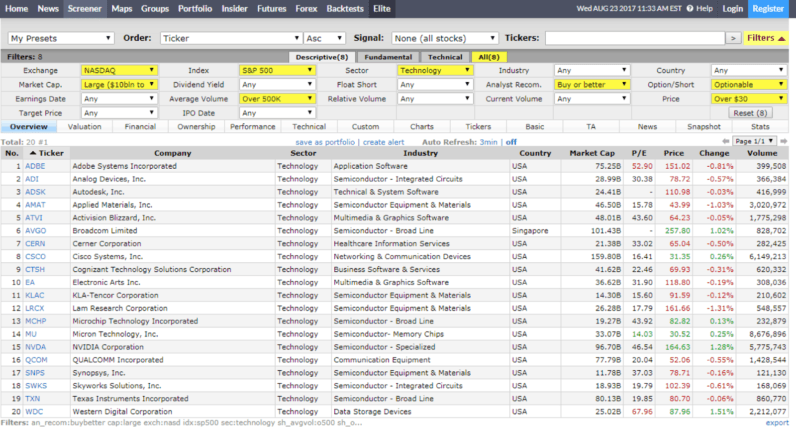

MarketWatch, Google, FinViz, Zacks among others offer free stocks screening software – your broker may also have specialized screening software on their trading platform. The image below is a screenshot of a stock screen done on finviz screener.

The screener is set to show stocks trading on Technology stocks with a share price of at least $30 per share, with a market cap of at least $10B, sporting an average trading volume of more than 500K trades on the NASDAQ exchange. The stocks also need to be optionable (you can buy or sell its options) and they must have an analyst rating of “Buy or Better.”

Trading bots

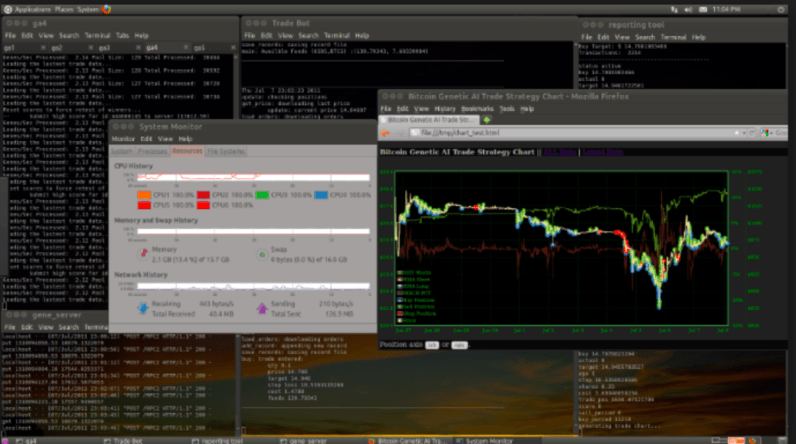

You can also automate your trades online by using a trading bot. These bots are simply computer programs with instructions to execute a trade on your behalf based on a predetermined set of market indicators and parameters. Automated trading systems can be used to trade stocks, options, futures and foreign exchange products based on a predefined set of rules, which determine when to enter an order, when to exit a position and how much money to invest in each trading product.

Trading bots can increase the odds of success for newbie traders by bridging the gap between their inexperience and events in the market to make sound trading decisions. These automated systems can also reduce your direct involvement in the markets so that you have ‘someone’ watching over your portfolio in your absence. While you are at work, traveling, or sleeping, your bot will be looking for new opportunities to book gains in the market.

Trading bots are especially helpful to beginner traders because they have logic on their side; they make trading decisions based on facts, whereas emotions and sentiments are likely to cloud the reasoning of inexperienced traders. In addition, it’s important to understand that trading bots are not created solely to help you book profits – sometimes; a bot can be an important market ally for reducing your losses.

Trading algorithms

Many new traders tend to confuse trading bots with algorithm trading – yet they are fundamentally different. Algorithmic trading is simply a tool designed to help traders execute orders automatically based on pre-programmed trading instructions such as price, volume, and timing. You can also use algorithmic trading to break down large orders that your trading platform can’t execute in a single trade.

The primary function of algorithmic trading is to help you manage costs and minimize risks. Using algorithmic trading for large orders can also help institutional investors or individual investors with deep pockets to avoid spooking the markets.

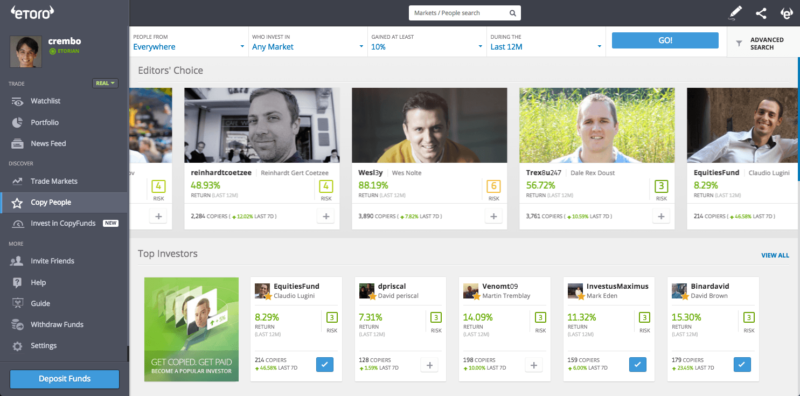

Social trading

A third option beginners should consider if they want to reduce the trading learning curve, is social trading. Social trading is simply a type of trading in which traders rely on user-generated financial content, collated from a variety of networks, to make trading decisions. Social trading provides you the platform to be part of a community of successful traders so that you can distill the wisdom of the crowd to make trading decisions.

You can utilize social trading to engage in the trading of different types of securities such as stocks, forex, commodities, and cryptocurrencies. Social trading is also closely associated with copy trading – with copy trading you have an opportunity to copy the trades of other traders to make your trading decisions.

3 common mistakes beginners should avoid

Not using a trading plan

Many new traders are eager to enter the market to start placing trades and start making money. However, entering the market without a well-thought-out trading plan often results in massive losses. Without a trading plan, you’ll mostly be reacting to events in the market instead of acting logically.

Underestimating the importance of a trading journal

A trading journal is a useful trading tool that can fast track your mastery of the markets. Recording all your trades, the investment thesis behind the trades and noting how the trades turn out can help you improve your trading acumen. A trading journal also makes it easy for you to do the post-trading analysis to crunch data and prepare for the next trade.

Changing trading strategy after every trade

Some traders experience beginner’s luck when they start trading; however, most new traders tend to lose some money because of their propensity to making trading mistakes. However, changing your trading strategy after every loss will only set you back on the learning curve because you’ll never really master any of the trading strategies.

Now that you’ve gotten actionable information to begin your trading journey, it’s time to get started on the right foot. eToro helps traders improve the odds of their trading success by providing a platform where you can automatically copy the trades of other successful and experienced traders.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. All trading involves risk. Only risk capital you are prepared to lose. This content is intended for educational purposes only, and shouldn’t be considered investment advice.