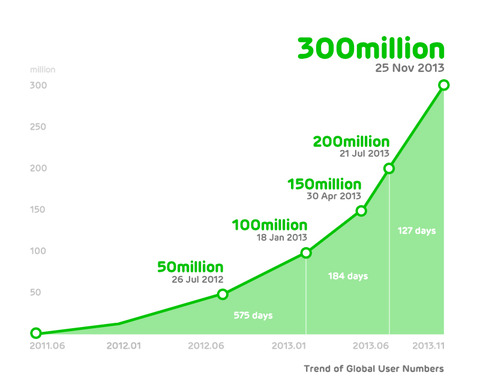

Line, the mobile messaging service from Japan, has made a huge push in Europe and Latin America, and is now celebrating passing 300 million registered users, one-third of which have signed up over the last four months — that’s two months quicker than it took to grow from 100 million to 200 million users.

However, it is only now planning a renewed assault on the US market, after changing its focus earlier this year and seeing growth decline there, Jeanie Han, CEO of Line US, tells TNW.

The company has been aiming to hit the milestone before the end of the year, and it’s made it with over a month still to go, as an official announcement confirms. There has been plenty of talk about a multi-billion dollar IPO — with some rumors suggesting it would follow the 300 million user announcement — but Han says the company has no comment on the speculation.

Focus switched from US to Latin America and Europe

Speaking in an interview, Los Angeles-based Han says Line is focused on building out its business outside of Asia. The company has strongholds in Japan, Taiwan, Thailand and Indonesia, but it is ramping up its presence in Europe and the Latin America.

Line made a big push to break the US market at the beginning of 2013 and, after gaining some traction thanks to a significant marketing campaign, growth slowed as Line’s app promotional activities eased off.

Han says that Line didn’t fail or pull out of the US — instead it deliberately changed its focus to provide resources to other markets that needed attention more urgently.

“We originally thought we’d move in on the US, but then Latin America grew faster than we thought, and the timing there was more critical.”

In addition to the more pressing needs of other markets, Han — who heads up Line’s business in the US, Latin America and Europe — admits that the US requires a more tactical approach.

“We do have plans to launch in the US, but it’s a very fragmented market with strong competition. We need to be strategic and cautious: we didn’t move as quickly there as the market needs more care.”

Building from organic growth

Han doesn’t reveal exact details of the strategy Line will adopt in the US, but she suggests that it will be similar to the approach taken in Spain and other markets — Italy, France, Germany and the UK.

Han explains that the team monitors organic growth in each market and, where it sees the potential to scale, it begins local initiatives and media activity to encourage greater visibility.

The first phase of the rollout is typically ads that use mainstream channels like TV and billboards to encourage downloads, then, once a user base has been established, Line introduces localized content — such as stickers, games and famous users — and partner influential companies, including operators, to grow engagement.

In Spain — a market that Line considers a key success story — its initial tactics spurred more than 15 million downloads. A content push is currently underway, part of which saw the Barcelona and Real Madrid football teams clock up 12 million followers each over just three days, while tennis star Rafael Nadal was another high-profile name brought on to help.

Despite clear evidence of traction, Line doesn’t provide active user numbers for Spain, any other market or its global user base as a whole, so it’s tough to directly compare to bigger fish like WhatsApp (350 million month active users) or WeChat (280 million active monthly users) — perhaps we can call that the Snapchat model.

Stickers and content

One part of Line’s content approach is stickers, the large emoticons that it first pioneered and are now offered and sold by the likes of Path, Viber, Facebook and others. The company offers localized stickers in many markets, but beyond simply engaging users they bring in money too: sales of sticker packs — alongside in-app purchases from its ‘connected’ games and revenue from companies using its marketing platform — totaled $188 million (19.1 billion JPY) in gross revenue for its last quarter of business.

That’s a 48 percent increase on the previous quarter, and it’s more than Twitter made over the same period — although Line does not disclose its net profit/loss.

Han says that while the competition has embraced stickers, Line “knows what works” and it isn’t simply offering famous brands and intellectual property (although it does have a lot of exclusive content). She also notes that, in many cases, Line stickers enable communication between users where there’s no common language or in countries whose alphabets are difficult to type out on a smartphone.

In general, Han is bullish about competition and the growth of messaging apps because she believes that the industry is so nascent outside of Asia. “As this industry really grows, we welcome other players because more competition makes the benefits of our service clearer,” she says.

Targeting 500 million users in 2014

Line is aiming to reach half a billion registered users next year and the US is sure to be a key component in reaching that ambitious goal.

“We’re just getting started in the US,” she says,”and are actively doing deals to secure good content. The US market is already mature for technology, the ratio of games and active smartphone users is high.”

All of these factors play to Line’s advantage but, as I recently wrote, one of the big questions is about culture: will US smartphone owners trade a simple messaging experience like that of WhatsApp for a complicated but feature-packed one such as that offered by Line?

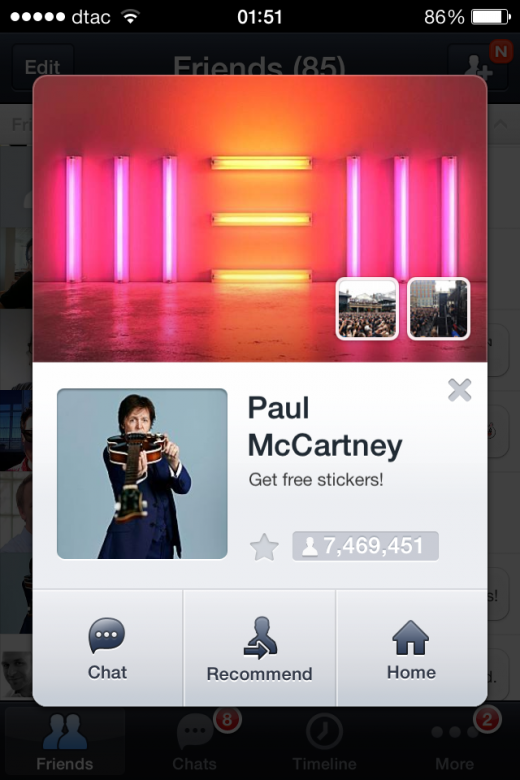

There’s certainly room to accommodate more than one player in the market, and Line will look to its celebrity users — which include Beatles singer Paul McCartney, who has over 7 million Line followers — and its games platform — Line’s 39 games have surpassed 200 million cumulative downloads — to stand out from the rest and offer a compelling experience.

Line isn’t alone in targeting the US messaging market with a differentiated product.

Tencent-owned WeChat, from China, is making a big push in Latin America too and is looking to expand its 70 million daily active users from overseas by launching an office in the US next year. WeChat offers stickers and brands, and is beginning to roll out games, like the Line platform.

There’s also competition from local companies. Tango, a US-based services that offers games and recently partnered music giant Spotify, has 130 million users; while Kik has most of its near-100 million user base in North America, and recently opened its HTML5 games platform to third party developers, with some impressive early results.

As it stands, the Line service is used in 230 countries worldwide. The company says it is ranked as the top free app in 60 of them.

Headline image via hushenpaul.pixnet.net

Get the TNW newsletter

Get the most important tech news in your inbox each week.