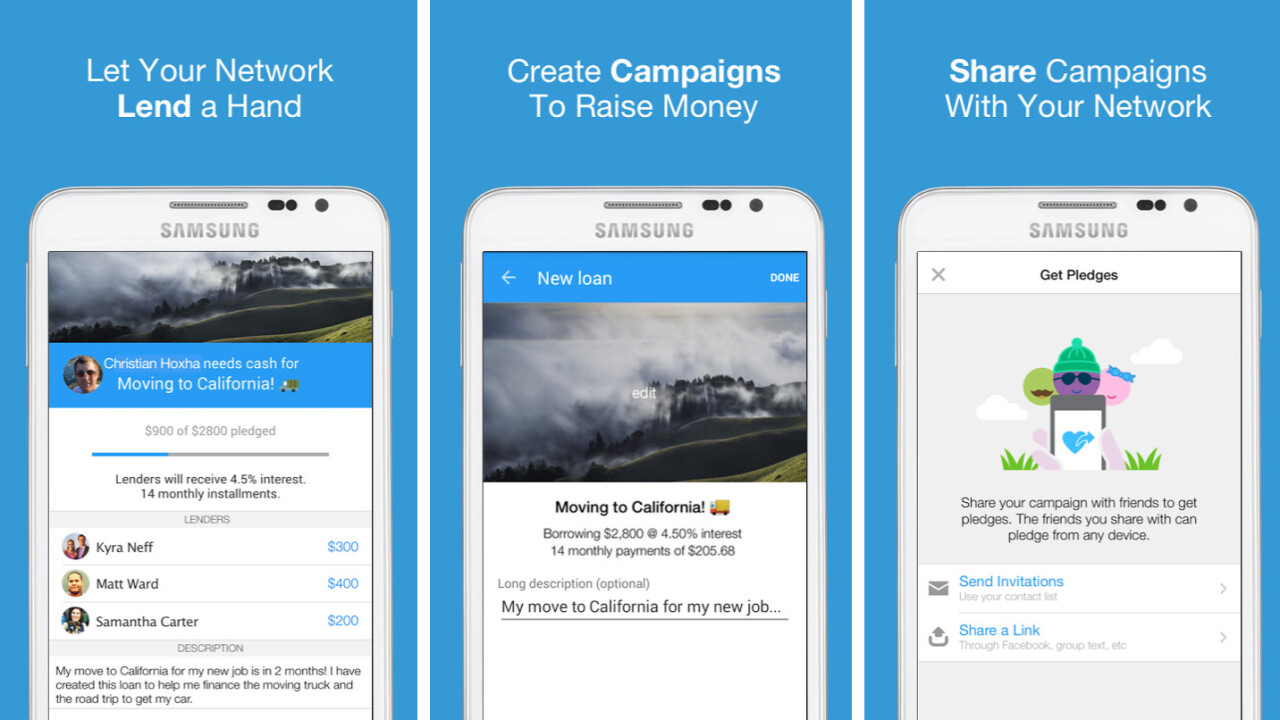

We’ve all been there – sometimes you simply need to borrow money. Whether it’s for a big investment, moving to a new place or life just getting a little rough, Ledge aims to make it dead simple to borrow money from friends, family and others – and actually pay them back.

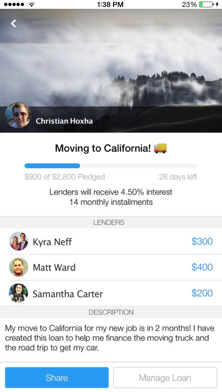

It essentially works like a crowdfunding platform, but with a few twists. After borrowers create a campaign explaining how much cash they need, they give the loan interest rate (which adds a lending incentive), and specify the number of installments payments will be made over.

Like on several other platforms, funds aren’t available until the goal is met. Payments are then automatically made via Venmo – neither the borrower nor the lender has to do anything after the initial campaign. There are also no fees, and Ledge takes no portion of the interest.

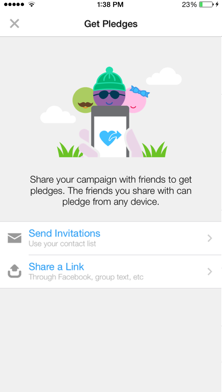

Your backers don’t even need the Ledge app to lend you money or recieve paybacks – you can share the campaign via social media and all it will require is a Venmo account. It would be nice to see some more options – PayPal (which owns Venmo) and Square Cash come to mind – but Venmo is the most popular P2P transaction system in the US.

Ledge is certainly not the first company to do personal crowdfunding – GoFundMe immediately comes to mind – but by forcing you to repay with interest, it doesn’t feel like you’re just mooching off of your friends.

Moreover, being paid back with interest gives your friends an incentive to actually want to lend you money, and the automation means there’s no hassle with remembering to pay back multiple people. If anything, having more pledges could mean smaller individual loans, which in turn will make it more likely for others to want to lend money as well.

There are also no credit checks, but Ledge has some systems in place to keep things under control. First, you can only borrow up to $5,000, and the repayment intervals are limited to six months (for a total of up to two years).

You can also only request 24 loans in any 12 month period, and Ledge sticks to state laws about maximum interest rates. If there do happen to be any payment disputes, Ledge will help mediate issues and work out modified payment plans.

If you want to give it a try, head on over to Ledge.me, or dowload the Android or iOS app.

Get the TNW newsletter

Get the most important tech news in your inbox each week.